Big Oil’s Wartime Bonus:

How Big Oil Turns Profits Into Wealth

Friends of the Earth and Public Citizen / Bailout Watch

(April 5, 2022) — February 24, 2022 was a terrible day for Ukraine, as Russia launched its invasion. It also was a great day to own oil company stock. The Texas driller EOG, awash in cash from high energy prices, declared it would treat shareholders to a bonus cash payout of $585 million via a special dividend. That same day, two other companies, Occidental and Ovintiv, announced their own double-digit dividend increases.

As the war drags into its second month, Big Oil remains the only winner in sight. To ensure its windfall profits land in investors’ pockets, companies rely on two main tactics: First, they repurchase shares of their own stock and retire them, reducing the number of shares outstanding and driving up the value of each share remaining in investors’ hands. Second, they increase dividends, the quarterly payments investors receive for owning shares.

Amid high gas prices and war in recent months, oil and gas companies have kicked both tactics into overdrive, a new analysis from Friends of the Earth, BailoutWatch, and Public Citizen has found:

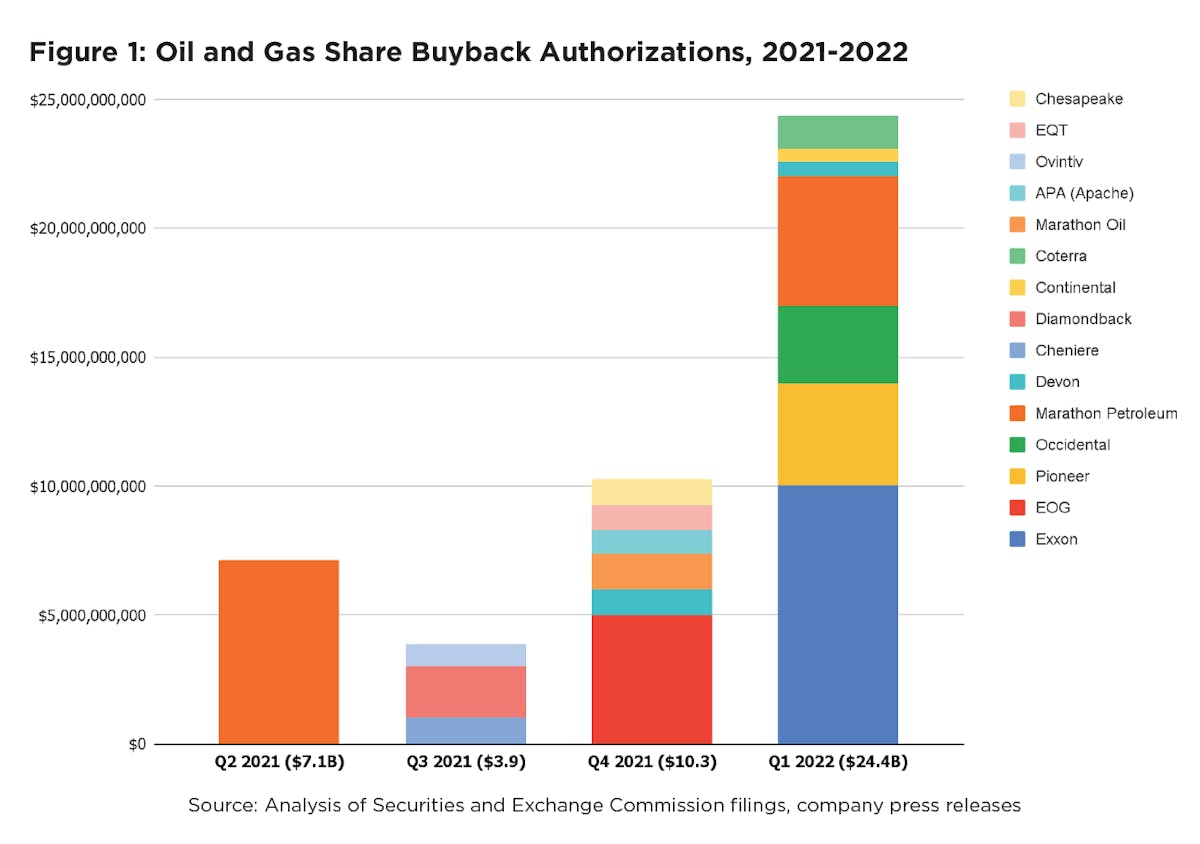

- In the first two months of 2022, seven companies’ boardsauthorized their corporate treasuries to buy back and retire$24.35 billion in stock — a 15% increase over all of the buybacks authorized in 2021. The total since the price spikes began is $45.6 billion.

- More than half the companies boosted their dividends, oftenextravagantly, in January and February. Eleven companieshave at least doubled their payouts, some from zero, since the first quarter of 2021.

- Six companies have begun paying additional dividends ontop of their routine quarterly payments, including byimplementing new variable dividends based on company earnings — a way of directing windfall profits immediately into private hands without any possibility of investment, employee benefits, or other uses. So far in 2022, these companies have started paying out an initial $3 billion in special windfall dividends.

- Four of these companies — Pioneer, Chesapeake, Conoco,Four of these companies — Pioneer, Chesapeake, Conoco,August 2021, as prices began to rise.

“To the oil and gas companies and to the finance firms that back them: …Russia’s aggression is costing us all, and it’s no time for profiteering or price gouging.” — President Joe Biden, March 8, 2022

Big Oil Companies Are Using Wartime

Profits to Enrich Investors, Report Says

Maxine Joselow / The Washington Post

(April 7, 2022) — Good morning and welcome to The Climate 202! Our friends at the Capital Weather Gang reported that climate change may be increasing the frequency of “false springs,” and we can certainly relate here in DC, where the cherry blossoms have given way to cold again. But first:

Exclusive: Big Oil Companies Are

Using Wartime Profits to Enrich Investors

The nation’s biggest oil and gas companies have significantly increased stock buybacks and dividends since Russia invaded Ukraine in late February, raising questions about whether the firms are using wartime profits to enrich investors instead of curbing Americans’ pain at the pump, three liberal advocacy groups write in a new report shared exclusively with The Climate 202!

The report released today by Friends of the Earth, Public Citizen and BailoutWatch turns up the heat on the fossil fuel industry ahead of two high-profile congressional hearings this week, when Democrats plan to scrutinize the industry’s windfall profits amid rising crude prices sparked by the war in Ukraine.

The three groups looked at Securities and Exchange Commission filings and public statements from the 20 largest US-headquartered oil and gas companies, including Chevron, ConocoPhillips, Devon Energy, EOG Resources and ExxonMobil.

The groups’ analysis focused on buybacks, which often raise a company’s stock price, rewarding its shareholders. Critics say that buybacks inflate executive compensation while doing nothing to improve a company’s products and services. The groups also examined dividends, the quarterly payments that investors receive for owning shares.

The Main Findings:

- In January and February, seven companies’ boards authorized their corporate treasuries to buy back and retire $24.35 billion in stock — a 15 percent increase over all of the buybacks authorized in 2021. Six of those decisions came in February, after fears of Russian aggression against Ukraine lifted stock prices. In total, the 20 companies announced $45.6 billion in stock buybacks since the start of 2021.

- More than half of the companies boosted their dividends in January and February. Of the 11 companies raising their dividends, nine were increases of more than 15 percent and four were increases of more than 40 percent.

- Six companies have started paying additional dividends on top of their routine quarterly payments, including by implementing new “variable dividends” based on company earnings.

“This is a master class in war profiteering. Humanitarian disaster and consumer pain are being turned into Wall Street profits in real time,” Lukas Ross, program manager at Friends of the Earth and co-author of the report, told The Climate 202.

One could argue that boosting payouts to investors could be a net positive for the climate, should those investors choose to reinvest their money in renewable energy companies rather than fossil fuel firms. But Alan Zibel, research director at Public Citizen and another co-author of the report, questioned whether that scenario was realistic.

“I wouldn’t necessarily count on investors who collect oil dividends to foster the green energy transition,” Zibel said.

Spokespeople for the oil companies did not immediately respond to requests for comment.

Oil Execs in the Hot Seat on the Hill

The analysis comes after top Democrats on the House Oversight Committee yesterday sent a letter to executives at ExxonMobil, BP America, Chevron and Shell urging them to use their surging profits to help lower gas prices and invest in clean energy.

“Big Oil must immediately stop profiteering off the crisis in Ukraine,” says the letter from House Oversight Chair Carolyn B. Maloney (D-N.Y.) and Oversight Subcommittee on Environment Chair Ro Khanna (D-Calif.).

Meanwhile, the Senate Commerce, Science and Transportation Committee will hold a hearing at 10 a.m. Eastern today titled “Ensuring Transparency in Petroleum Markets.”

- The Commerce committee originally invited the executives of ExxonMobil, BP andPioneer Natural Resourcesto testify at the hearing, but all three companies declined to appear in person. A committee aide told The Climate 202 that the panel still hopes to host the executives at a later date.

- In the meantime, the committee today will hear fromRobert McCulloughof McCullough Research, an energy-consulting firm. He was one of the first people to voice concerns about Enron, the Texas energy company that declared bankruptcy in 2001 after revelations of accounting fraud and inflated profits.

- Republicans invited as their witnessKathleen Sgamma, president of theWestern Energy Alliance, a trade group that advocates for oil and gas production in the West.

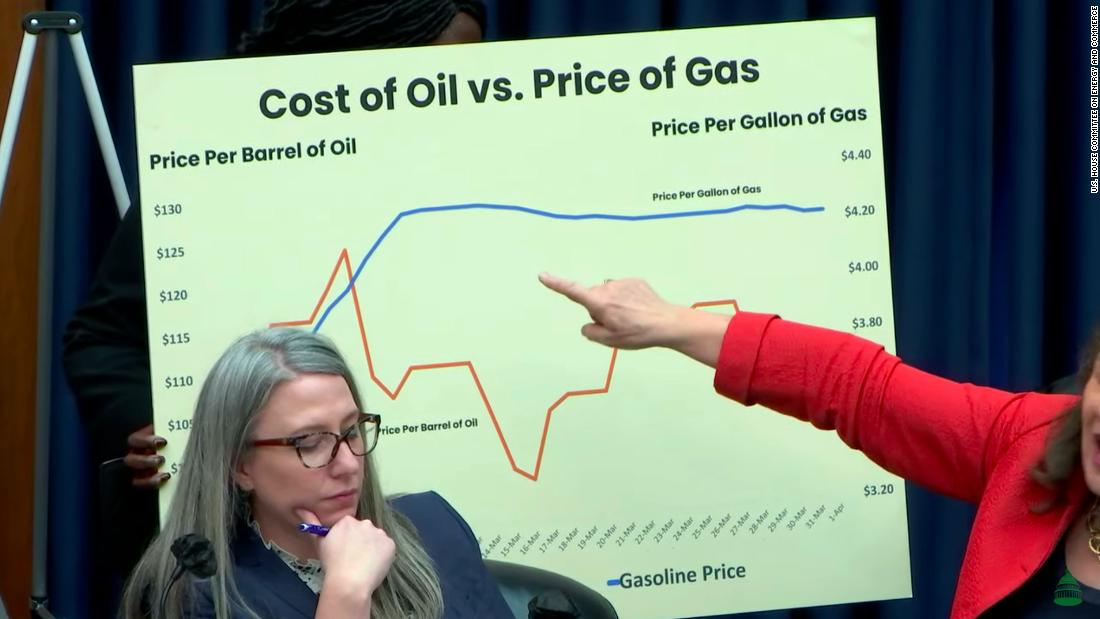

The House Energy and Commerce Committee also still plans to hold a hearing Wednesday featuring the executives of six fossil fuel firms and titled “Gouged at the Gas Station: Big Oil and America’s Pain at the Pump.”

International Climate

The world is running out of options to reach climate goals, U.N. report shows.

After decades of inaction on climate change, the world is on track to speed past a crucial target of limiting global temperature rise to 1.5 degrees Celsius (2.7 degrees Fahrenheit) by 2030, 278 of the world’s top scientists said Monday in the latest U.N. Intergovernmental Panel on Climate Change report, The Washington Post‘s Sarah Kaplan and Brady Dennis report.

Despite the planet already being pushed into unprecedented territory, with ravaged ecosystems and rising sea levels, the scientists said it’s still possible for nations to have a shot at limiting global warming — but humans must halve greenhouse gas emissions in the next eight years.

The report’s authors cautioned, however, that this goal “cannot be achieved through incremental change.” Instead, securing a less catastrophic future requires an almost immediate “societal transformation,” they wrote.

The nearly 3,000-page document marks the IPCC’s first assessment of Earth’s remaining strategies for climate action since the 2015 Paris agreement. It details how coordinated efforts to deploy more renewable energy, overhaul transportation systems, restructure cities, and pull carbon from the air could put the planet on a more sustainable path while improving living standards around the globe.

On the Hill

Sens. Manchin, Cramer oppose SEC climate risk rule, saying it targets fossil fuel companies.

In separate letters, Sens. Joe Manchin III (D-W.VA) and Kevin Cramer (R-ND) wrote to the Securities and Exchange Commission opposing its proposed climate disclosure rule, which was announced last month and would require all publicly traded companies to disclose their greenhouse gas emissions and the risks they face from climate change in a standardized way for the first time.

Manchin, a key Democratic vote on climate policy, wrote to the SEC on Monday that the proposed rule is beyond the agency’s authority, and that such policies will add “undue burdens on companies,” specifically those in the fossil fuel industry, Pippa Stevens reports for CNBC.

Meanwhile, Cramer led Republican members of the Senate Banking and Environment and Public Works committees in a letter this morning calling on SEC Chair Gary Gensler to withdraw the rule.

“After failed attempts to enact radical climate policy via legislation, this rule is yet another example of the Biden Administration’s efforts to have unelected bureaucrats implement its preferred agenda through regulation,” the senators wrote in the letter.

The SEC’s proposed rule is in a 60-day public comment period.

Agency Alert

Administration unveils plan for improving school infrastructure

Vice President Harris on Monday announced an action plan to invest in the nation’s public school infrastructure, including by helping schools make energy efficiency retrofits and switch to electric buses.

The plan, which leverages investments from the bipartisan infrastructure law, spans several federal agencies:

- TheEnergy Departmentreleased a request for information for a $500 million grant program to make schools more energy efficient, thereby lowering their energy costs and improving air quality for students and teachers.

- TheEnvironmental Protection Agencylaunched online resources to help school districts prepare for a $5 billion clean school bus program created by the infrastructure law. The program aims to avoid diesel exhaust from bus tailpipes, which produces pollutants that can aggravate asthma in children.

Pressure Points

Climate change could cost the federal government $2 trillion a year by 2100, White House says.

Extreme weather events fueled by climate change could cost up to $2 trillion each year from the nation’s federal budget by the end of the century, according to a first-ever assessment released Sunday from the White House Office of Management and Budget, Timothy Gardner reports for Reuters.

“Climate change threatens communities and sectors across the country, including through floods, drought, extreme heat, wildfires, and hurricanes (affecting) the US economy and the lives of everyday Americans,” Candace Vahlsing, an OMB climate and science official, and its chief economist Danny Yagan, said in a blog post. “Future damages could dwarf current damages if greenhouse gas emissions continue unabated.”

The assessment, which came hours before the new U.N. Intergovernmental Panel on Climate Change report, found that the federal government could spend an additional $25 billion to $128 billion a year on climate-related expenditures such as coastal disaster relief; flood and crop insurance; and wildfire suppression.

Extreme Events

Cold snap in Europe breaks records and stuns spring crops.

A record-setting April cold snap has hit Europe for the second year in a row, with temperatures falling 20 to 30 degrees below normal, triggering harsh frosts and shocking early blooming plants in multiple countries, The Post‘s Jason Samenow and Kasha Patel report.

The bout of cold weather comes after warmer-than-normal temperatures in recent weeks that prompted a rapid greening of vegetation in the region. Climate scientists say that frequent warming in the late winter months could be increasing the rate of “false springs,” which make crops more vulnerable to the threat of frigid temperatures after blooming.

Some research also shows that climate change may exacerbate cold spells in certain times and places because of more erratic jet stream behavior even if winters are globally warmer, although the notion is under debate in the scientific community.

Viral

And now here’s some good zebra-related news after all of that dark climate news:

A rare species of Zebra discovered at Serengeti National Park in Tanzania. pic.twitter.com/OGOGS4M1nu

— Zoom Afrika (@zoomafrika1) April 3, 2022

Posted in accordance with Title 17, Section 107, US Code, for noncommercial, educational purposes.