Billionaires Are Just One Symptom of

Our Upside-down Economic System

Chris Winters / Yes! Magazine

(February 27, 2023) — In 2019, US Rep. Alexandria Ocasio-Cortez made headlines at the MLK Now conference. When Ta-Nehisi Coates asked whether the world is moral when it allows billionaires to exist, she answered, “No. It’s not.”

Ocasio-Cortez explained that, while she doesn’t necessarily think individual billionaires are immoral, “I think it’s wrong that a vast majority of the country does not make a living wage; I think it’s wrong that you can work 100 hours and not feed your kids; I think it’s wrong that corporations like Walmart and Amazon can get paid—they can get paid by the government essentially, experience a wealth transfer from the public—for paying people less than a minimum wage. It not only doesn’t make economic sense, it doesn’t make moral sense, and it doesn’t make societal sense.”

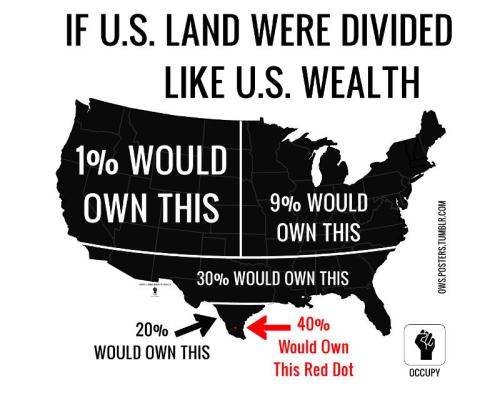

Many politicians, activists, and commentators have voiced similar sentiments: No one should have a billion dollars. Yet there are now nearly 1,000 billionaires in the United States alone, according to Visual Capitalist, with a combined net worth of more than $4 trillion. When the COVID-19 pandemic triggered a global recession, the richest Americans saw their wealth increase by 40%.

At the same time, as Ocasio-Cortez and others have pointed out, 37.9 million people in the US live below the poverty line. Some researchers estimate that at least 27 million people earn less than $30,000 a year, or about $14.42 per hour for full-time work, the mean minimum amount a single adult with no dependents needs to afford food and rent in an average-sized city.

The federal minimum wage hasn’t been raised since 2009, and even then only to a paltry $7.25 per hour. One of the world’s largest companies in both revenue and employees, Walmart pays thousands of workers so little that they need food stamps to buy groceries—often at the same store they work in.

Billionaires are a byproduct of an upside-down economic system. Wealth inequality is often seen as a problem that can be solved by spreading wealth more equally. But that solution bypasses the central problem of what wealth—as opposed to income, or just “lots of money in the bank”—really means in a consumer capitalist society.

In such a society, wealth is not only the accumulation of economic power, but it is also a marker of importance, status, and privilege. It identifies the alpha dog in the pack and gives that dog freedom to do things — even abusive, illegal, or violent things — that would not be tolerated from anyone less wealthy.

Our modern conception of wealth insists that wealth corresponds to moral worth, a concept at odds with any society that believes all people are created equal. Inequality isn’t the root of the problem, in this case. It’s just a symptom of the real problem: wealth, and all the privileges and power attached to it. So let’s put an end to it.

Housing Is the Foundation

There are several ways of eradicating the system that allows wealth to concentrate in the hands of fewer people. Attempts to stimulate economic growth — often through the tax code, but also direct investment by the government — usually benefit just the top 10% of household incomes, says Dedrick Asante-Muhammad, the chief of membership, policy, and equity at the National Community Reinvestment Coalition, an association of more than 600 community organizations working to increase the flow of private capital into traditionally underserved communities.

Housing is where most middle-class Americans begin to build their financial security, even if it doesn’t lead directly to wealth. But the escalating cost of housing also prevents low-income people from rising out of poverty. Mechanisms that built the post-war middle class, like the massive construction of affordable and public housing in urban areas, were initially reserved for white workers. The large-scale movement of Black Americans into that housing also corresponded to a disinvestment in its maintenance and upkeep, which further increased the racial wealth gap in America.

“[Public housing] was a positive step, and a mixture of racism and economic marginalization made those [places] ghettos,” says Asante-Muhammad. “But they don’t have to be ghettos.” Upgrading affordable housing and closing the gap between the need for housing and the available supply would require a massive government investment in urban and suburban areas. Rent subsidies in the form of vouchers, currently the most effective tool we have to help low-income Americans pay for housing, are only available to 24% of the households that need them, according to the Center on Budget and Policy Priorities.

The 2023 budget approved by Congress would fund just 25,000 new rental vouchers, according to the National Low Income Housing Coalition. That’s a fraction of what’s needed to bridge the affordable housing gap: 5.3 million US households receive federal support, including through vouchers, Section 8 project-based assistance, or public housing, but an estimated 16 million low-income households that need aid can’t receive it because funding isn’t available. And that doesn’t even begin to address the lack of physical housing. The Urban Institute has estimated there are just 29 adequate and affordable housing units available for every 100 families that need one.

Tax It Back

Almost no economic reform program comes without incorporating a more progressive income tax. Ocasio-Cortez has advocated for a top marginal tax rate of up to 70% on families earning more than $10 million per year (the current rate on top earners for 2023 is 37%). For nearly two decades following World War II, a period corresponding to the US’s greatest economic expansion, the top marginal rate was above 80% and often higher than 90%. The top rate didn’t dip below 70% until 1981, when the Reagan administration suggested using tax cuts for the wealthy to spur economic growth. Today, after 40 years of these policies, there is no evidence they work.

Raising income taxes on the wealthy will only go so far, however. A 70% top marginal rate that kicks in at the 10,000,001st dollar would only net about $720 billion over a decade, according to a Washington Post analysis. That’s because wealthy Americans derive most of their wealth from investment returns (aka capital gains), interest, and dividends, not from salaries. And investment income is taxed at a much lower rate than income is.

But a radical hike in income tax combined with other measures, such as reforming the estate tax, raising capital gains tax rates, and imposing a European-style wealth tax, could raise up to $3 trillion over a decade, according to the Post’s analysis. That amount, $300 billion per year, only amounts to about 4.8% of what the US government spent in 2022.

How that money is allotted would determine how much it affects the nation’s wealth gap. But given the messy manner in which laws are enacted, it’s likely that only a fraction of that amount would realistically be available.

Reforming Charity

Charitable foundations are an enormous repository of wealth in the US, in particular the foundations whose initial endowments originated in big family fortunes—the Rockefellers, Fords, and Gateses, for example. Foundations distributed $90.9 billion in donations in 2021, according to Giving USA, often to causes that support the poorest of Americans. Big giving is loudly touted on corporate public relations missives, by major foundations, by wealthy individuals, and sometimes by the recipients themselves.

But foundations also are sitting on approximately $1.1 trillion in assets, and federal law only requires they pay out 5% of their endowments each year, a rate that hasn’t increased since it was enacted in 1976. Donor-advised funds, a newer form of philanthropic endeavor, aren’t required to pay out anything, and they held an additional $159.8 billion in assets in 2020.

Foundations are sitting on approximately $1.1 trillion in assets, and federal law only requires they pay out 5% of their endowments each year, a rate that hasn’t increased since it was enacted in 1976.

“The fact that you could start a foundation or start a donor-advised fund and those dollars get the tax benefits of doing that, and those resources potentially never see the light of day or have any public benefit, to me is ridiculous,” says Edgar Villanueva, founder of the Decolonizing Wealth Project. On top of that, philanthropic endowments are often invested in the same economic structures and corporations that created the social problems that philanthropy is intended to address.

Villanueva and others have pointed to the fact that this largely white sector often supports well-known charities with established connections to philanthropy instead of nonprofits led by Black, Indigenous, or other people of color working in those communities.

That’s created a lopsided system in which nonprofits gear their operations around the needs of wealthy funders rather than the needs of communities. “We have created a system that allows for such massive concentration of wealth and resources to individuals, while at the same time underfunding infrastructure, social infrastructure, [and] social safety for working-class, low-income people,” Asante-Muhammad says. “So then people are just begging to get a Bill Gates grant when, honestly, in the scheme of things, even Bill Gates or Elon Musk doesn’t have the money to do what is needed to address these massive social issues.”

The Decolonizing Wealth Project’s reparative philanthropy framework, which Villanueva outlined in his book Decolonizing Wealth: Indigenous Wisdom to Heal Divides and Restore Balance, involves using money as a tool for healing, so that philanthropy doesn’t perpetuate exploitative systems.

“We have to be honest and transparent around what has transpired, how wealth has been built in this country,” he says. “The fact that we have a scarcity mindset is a byproduct of the history of colonization or the history of how wealth has been accumulated, where so many of us have internalized not having enough.”

Philanthropy was set up not as a purely altruistic endeavor, Villanueva says, but one driven by wealthy industrialists giving themselves an image makeover. And US tax policy rewards that behavior. “Not only are you becoming wealthier, your reputation is boosted as a person who is charitable, who is doing good in the world,” he adds. Bill Gates famously declared in 2012 that he was going to give away all his wealth through his foundation. A decade later, he’s nearly twice as rich as he was back then.

That’s why the example of MacKenzie Scott, who has given away $14 billion to more than 1,600 nonprofit organizations since 2019 in no-strings-attached grants, is an outlier. Scott, the ex-wife of Amazon founder Jeff Bezos, has largely stayed out of the spotlight and eschewed the traditional application-based model of grant-making. Her initiative, Yield Giving, plans an open-call type of application process in the future, and Villanueva appreciates her hands-off approach. “I think she is changing the game and probably making a lot of billionaires uncomfortable,” he says. “But even she, as fast as she is giving her money away, it just keeps accumulating.”

Returning Common Wealth to the Commons

Ending the destructive effect of wealth on society requires interrupting the processes that started its accrual. The first thing white settlers did once they arrived in the Americas was claim ownership of the land, despite many Indigenous societies’ beliefs that the land was a common charge. “There’s a fair amount of what we call ‘wealth’ [that] is the commons extracted [and] privatized by individuals,” says Chuck Collins, director of the Program on Inequality and the Common Good at the Institute for Policy Studies.

Europeans had a concept of “the commons,” but by the time colonization of the Americas began, it had been shrinking relative to private land ownership. By the 20th century, the commons had largely disappeared. At that point, land ownership and inheritance had become powerful engines of wealth accumulation and consolidation of family dynasties.

After this looting of the ecological commons created early fortunes, the wealthy protected their gains by eliminating competition and ensuring their businesses received favorable treatment from the government. And they ensured their wealth could be passed along to their heirs.

But the compounding effects of dynastic wealth were known even then. In 1891, the progressive economist Richard T. Ely noted that reforming inheritance laws was one of three key policies that would have the greatest positive effect on society. “If we’re going to talk about reducing wealth inequality, not only do we want to tax and redistribute, but we also want to prevent, discourage, or tax the initial extraction,” Collins says.

Only now, in the 21st century, are movements gaining some traction in returning land to its original stewards. The LandBack movement has grown in the US and Canada, with Native tribes fighting to place more land in trust for reservations and, in some places, such as Northern California, even receiving their historical land back.

Collins sees Indigenous forms of collective land stewardship as a promising model for interrupting the amassing of wealth and redistributing it to those from whom it was originally taken. Another form of collective ownership growing in popularity are community land trusts, where removing housing from the speculative market is seen as a way of preserving both affordability and communities.

In response to various reparative approaches, some among the superrich have simply hidden their wealth from taxing authorities. In 2021, ProPublica used leaked IRS data to reveal that half of the 100 richest people in the US were using the trust system to keep their wealth out of reach. “It’s not a sideshow, it’s the main stage,” Collins says. “We know how little money the estate tax raises now, and it’s sort of laughable how porous or almost voluntary it is.”

The federal government brought in about $15.6 billion in estate taxes in 2019, according to the Tax Policy Center. State and local governments brought in another $5.4 billion in 2019, according to the Urban Institute. “But if you think about how much wealth transferred from one generation to the next among that super-wealthy group last year, 2021, it’s probably more than $1 trillion,” Collins says. “So it’s capturing just a tiny, minuscule sliver.” If we’re really going to upset the accumulation and concentration of wealth in fewer and fewer hands, the people will need to find ways to capture a larger piece of that pie.

Wealth inequality has skyrocketed in recent years; there are now nearly 1,000 billionaires in the US alone. The wealthiest Americans have never been richer, while poor and working-class Americans have seen their incomes stagnate and fall. Radical government intervention in the economy to redistribute wealth could help bridge the gap. Here are several policies that could bring a much-needed infusion of cash into the public coffers.

A European-style tax on overall wealth on the top 1% would net about $3 trillion over a decade.

Raising capital gains taxes, currently capped at 20%, could raise anywhere from $104.9 billion to up to $1.7 trillion over 10 years.

Reverting the estate tax to 1982 levels, when the top rate was 65% and the exemption level was just $520,000, would collect about $169 billion per year, or $1.7 trillion over a decade.

Imposing a 70% top marginal income tax rate on those earning more than $10 million could bring in $720 billion over 10 years.

Sources:

The Washington Post, Brookings Institution, US Treasury Department

Chris Winters is a senior editor at YES!, where he specializes in covering democracy and the economy. Chris has been a journalist for more than 20 years, writing for newspapers and magazines in the Seattle area. He’s covered everything from city council meetings to natural disasters, local to national news, and won numerous awards for his work. He is based in Seattle and speaks English and Hungarian

Posted in accordance with Title 17, Section 107, US Code, for noncommercial, educational purposes.