World Bank Is Still Funding

Our Polluting Carbon Economy

Claire O’Manique / Oil Change International

(July 6, 2023) — Recently, the World Bank called on countries to end their fossil fuel subsidies and redirect those funds to support a livable planet. The only problem? The World Bank provides more public finance for fossil fuels than any other Multilateral Development Bank (MDB) and continues to push for new fossil fuel subsidies through development policy finance.

ACTION:

Add your name and tell the World Bank to take

its own advice and stop funding fossil fuels!

Though the recently appointed World Bank President, Ajay Banga, was not the best choice for climate or our planet, he has recently signaled that he wants to move the Bank forward on climate.

This provides a rare opportunity for us to make some very loud demands for the new president to support initiatives that develop clean solar and wind power, and lift people out of energy poverty.

We’re calling on the incoming president to support urgent reforms to tackle poverty and the climate crisis — click here to send a message directly to newly appointed President Banga.

Since President Banga assumed office at the beginning of June, we only have a very short window to influence his policy agenda as President of the World Bank.

Here are our demands:

- Stop funding fossil fuels, and redirect money and support to a fair and just transition to renewable energy;

- Ensure access to clean, affordable energy for all;

- Stop unjust lending policiesthat further oppression and deepen inequality.

The World Bank is a powerful financial institution that could help lift people out of poverty, improve access to clean, renewable energy, and help us fight the climate crisis. But it needs to do more. Please add your name to our demands and urge President Banga to prioritize ending fossil fuels and ensure energy access for all.

Many thanks.

Claire O’Manique is the Public Finance Analyst for Oil Change International

Latest Data: World Bank Group

Still Locking-in a Fossil-fuel Future

Claire O’Manique / Oil Change International Blog

(April 4, 2023) — Ahead of the 2023 World Bank Spring meetings, we have compiled the major multilateral development banks’ (MDBs) 2022 energy finance data for the first time. Our analysis shows that while their fossil fuel support has dropped and renewables have increased, these influential public banks are still not aligned with a safe, 1.5°C-aligned future. Worse, data on their likely-even-larger “indirect” forms of fossil support is still almost entirely unavailable.

With outgoing World Bank Group (WBG) President David Malpass under fire for climate denial and debates about their ability to channel climate finance money effectively, multilateral development banks (MDBs) are under more public scrutiny than ever. At COP27 last year, there were growing calls for reform to global financial architecture, with Barbadian Prime Minister Mia Mottley calling out the imperialistic nature of multilateral lending.

For more on what the WBG and its peers could be doing to meet this moment, read the Big Shift Coalition’s “Cheat Sheet” for the Spring Meetings.

Still Funding Fossils

The MDBs share a mandate for sustainable development and have made repeated joint commitments since 2016 to align their finance with the Paris Agreement. Yet between 2020 and 2022, the MDBs provided an annual average of USD 3.3 billion in direct fossil fuel finance.

While this total has dropped significantly, from USD 9.7 billion between 2017 and 2019, the latest climate science is clear, that we cannot afford new fossil fuel expansion if we are to limit warming to 1.5 degrees Celsius (ºC). Instead, we need a rapid phase-out of oil, gas, and coal, alongside a rapid scale-up of clean energy.

Overall:

- MDBs provided on average $3.3 billion a year to fossil fuel projects from 2020 to 2022, a significant decrease from their 2017 to 2019 average of $9.7 billion per year.

- The World Bank Group (WBG) provided the most finance for fossil fuels at $1.3 billion a year on average. At least 67% of this was for fossil gas, which the Bank’s current Climate Change Action Plan says can continue to be supported if it fits still-undefined climate and development criteria.

- The European Bank for Reconstruction and Development (EBRD) ranked as the second largest provider of fossil fuel support at $667 million a year.

- MDB support for clean energy was $20.3 billion per year from 2020 to 2022, 3.3 times the support for fossil fuels. In 2022 the MDBs provided $26 billion for clean energy finance, the largest amount since we began tracking them in 2008.

- There was no known MDB finance for coal between 2020-2022.

- Much of the MDB’s indirect energy support is not covered here and there are troubling signs these flows are heavily weighed towards fossils. This includes finance delivered through financial intermediaries like other banks or private equity funds as well as most policy-based lending, which is non-earmarked budget supports for policy reforms for entire sectors or broad programs. Policy-based lending can account for as much as 40% of MDB total lending in a given year and currently has no restrictions on fossil fuel expenditures.

Who Is Getting Energy Support?

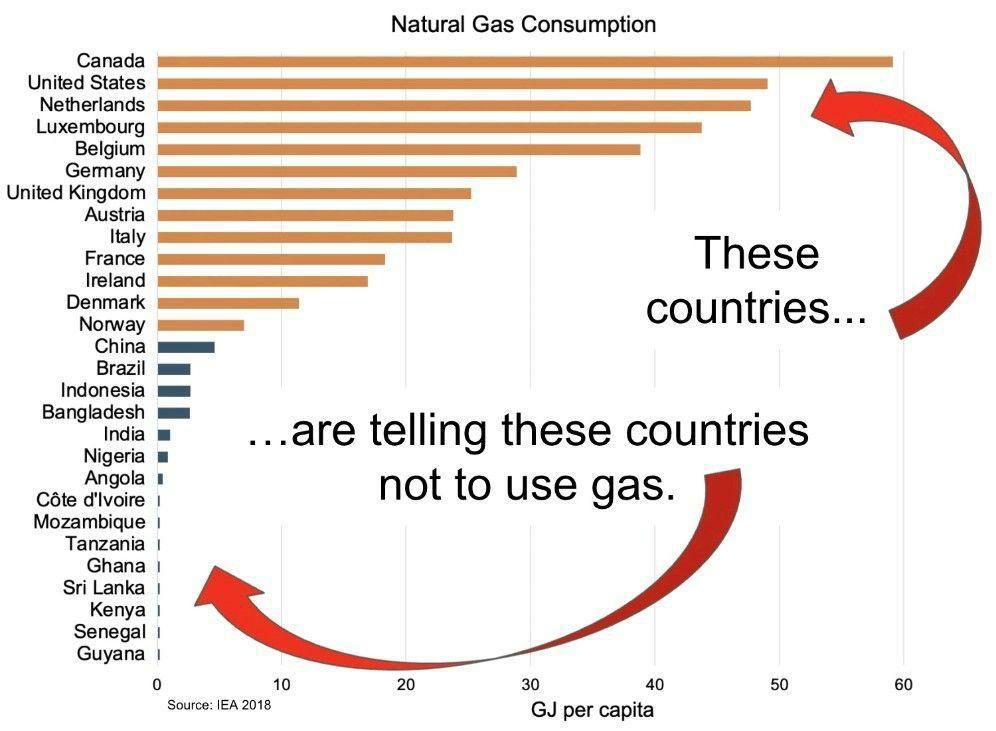

The main recipients of public support — whether fossil or clean — continue to be wealthier countries while the world’s poorest countries get left behind. The largest share of all energy finance (clean, fossil and other) went to Central and Western Europe between 2020 and 2022. The region also received 58% of all clean energy finance. This is driven by the EIB as the largest supporter of clean energy because most of their finance is directed to flow within the EU.

As Figure 3 shows no low-income countries and only three low-middle-income countries were among the top 15 recipients of clean energy finance. This contrasts finance for fossils, (Figure 4) where two low-income countries and five low-middle-income countries were among the top 15 recipients of fossil fuel finance, the majority of which (68%) went to support gas projects.

This trend is troubling, it risks locking countries into high emissions pathways, and economic instabilities associated with gas, further exacerbating climate change in countries with some of the fewest resources to manage the impacts despite contributing least to the problem. There are also well-documented human rights violations, displacement, and local health and environmental impacts from the fossil fuel industry wherever it extracts. And as recent projects in Indonesia, Pakistan, and Bangladesh show, MDBs often have a direct hand in making these impacts even worse.

MDB Reform?

MDBs have high levels of concessional finance relative to other kinds of institutions, as well as influential policy and research tools. This means that their finance for fossil fuels generally acts as a more significant subsidy to the industry on a per-dollar basis compared to other kinds of public finance institutions like export credit agencies. It also means that MDBs could be powerful catalysts for a globally just energy transition if they take this goal seriously, and implement long-standing recommendations to overhaul their governance.

The good news is there is more pressure for global financial architecture reform now than there has been in more than 20 years. This has partially been borne out of the recognition that the current financial system, including the MDBs, is failing to provide the climate finance and debts that are owed to countries in the Global South that have contributed least to the climate crisis but are bearing the brunt of impacts. With this, there is growing recognition that existing MDB governance and structures as is are not conducive to delivering the climate finance that would support a globally just transition.

Beyond concerns that many MDBs have continued to support fossil fuel projects, there are concerns that with their track record of privatization of public services and human rights violations, they can not be effective conduits for renewable finance without major reforms. In the context of this growing pressure, several proposals for MDB reform have emerged.

This includes the Bridgetown Agenda, which seeks to tackle the climbing debts of Global South Countries alongside climate and calls on the International Monetary Fund to inject at least $ 650 billion worth of reserve assets into struggling economies annually through Special Drawing Rights. In June 2023 French President Macron will co-host a summit for a new ‘Global Financial Pact.’

The World Bank Group has also developed an Evolution Roadmap to better address today’s global challenges. However civil society organizations quickly called out the serious lack of ambition of the proposed reforms, as a continuation of the status quo, and laid out the transformative reforms that are necessary to play a constructive role in a just energy transition to 100% clean energy.

There is more pressure for MDBs to change their ways now than there has been in decades, but we have also seen massive mobilization to change these institutions be stonewalled again and again. Counterproposals from civil society and progressive government shareholders will need to get a lot louder and more coordinated for us to see the needed changes on fossil funding, transformative climate solutions, democratic governance, and debt cancellation.

Multilateral Development Bank energy finance,

USD Millions, Annual Average 2020-2022.

Where possible, this includes indirect support but due to

a lack of reporting most is direct project finance.

| Coal | Oil & Gas | Other | Clean | Grand Total | |

| European Investment Bank | 0 | 363 | 3,489 | 12,046 | 15,898 |

| World Bank Group | 0 | 1,253 | 4,089 | 3,825 | 9,167 |

| European Bank for Reconstruction and Development | 0 | 667 | 1,031 | 1,470 | 3,168 |

| Asian Development Bank | 0 | 167 | 1,851 | 791 | 2,809 |

| Inter-American Development Bank | 0 | 110 | 1,090 | 1,144 | 2,344 |

| Asian Infrastructure Investment Bank | 0 | 95 | 791 | 510 | 1,396 |

| African Development Bank | 0 | 0.3 | 489 | 243 | 732 |

| Islamic Development Bank | 0 | 467 | 161 | 17 | 645 |

| New Development Bank | 0 | 145 | 0 | 183 | 328 |

| Grand Total | 0 | 3,267 | 12,991 | 20,229 | 36,487 |

More Information:

[1] “Hiding in plain sight: The missing trillions for climate change,” The World Bank, 06-15-23.

[2] “Biden has nominated a dangerous Wall Street executive for World Bank President,” Oil Change International, 02-23-23.

Oil Change International campaigns to expose the true costs of fossil fuels and facilitate the coming transition towards clean energy. We are dedicated to identifying and overcoming barriers to that transition.